Private Limited Company Registration in India

Package Includes (1 Year)

Company Registration

DIN, DSC, PAN, TAN

Share Certificates

GST & IT Filing

Send us an Inquiry

Register Your First Private Limited Company with Raj Softech BCS

Starting a business in India is a simple process in recent days. Registration of a firm or company takes a certain period, according to its nature of the business, business type, and other allied services. Raj Softech BCS is the best platform where you can complete the registration and other legal procedures on time. An expert crew of professionals will provide necessary guidance for your business formation and other legal compliance's.

A private limited company is a legal entity privately owned by a group of shareholders. The owners or the shareholders of the private limited company bound by the shares they hold. A Private Limited Company is a business organization that needs some objectives before its formation. The major objectives of a private limited company the members of the company minimum 2 to a maximum of 200. Another objective is the shares of the company are not directly sell to the public. In India, it is one of the common forms of business entity, more than 90% of business units are forming under this Private Limited Company. A group of people can start a private limited company anywhere in India under the guidelines of the Indian Companies Act 2013. After the registration, the name of the company should carry the suffix as”Private Limited Company”.

Startup

Market Price : ₹11999

Raj Softech Price : ₹8999 +GST

Government Fee : Included

Company Registration Services with Basic Incorporation Pack.

EMI Options Available | Transparent Pricing

Important Terms

Startup Plus

Market Price : ₹22999

Raj Softech Price : ₹18999 +GST

Government Fee : Included

Company Registration with GST Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

Startup Pro

Market Price : ₹34999

Raj Softech Price : ₹28999 +GST

Government Fee : Included

Company Registration with GST, ROC Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

Startup Proplus

Market Price : ₹42999

Raj Softech Price : ₹33999 +GST

Government Fee : Included

Company Registration with GST, ROC , IT, Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

RAJ SOFTECHPROTECT+

Protect your brand name. We will safeguard your company name and prevent misusing your brand reputation. We extend our support to increase protection:

A 10yr valid trademark registration certificate (+) Free expert advice to protect your brand name.

All this for Rs. 6999 only.

RAJ SOFTECH GO-LIVE

Today, a business website is mandatory to gain global exposure and meet more new customers every single day. With each business website you will get:

Free five (5) business emails (+) 1-year web hosting (+) '.com' domain name (+) a responsive website.

All this for Rs. 14999 only.

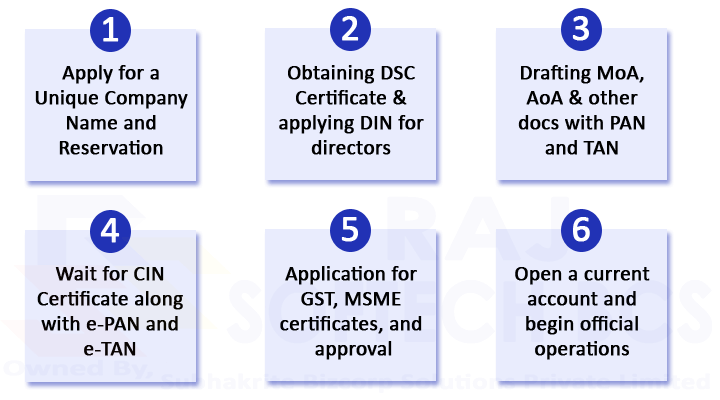

Our Company Registration Process

Photo Proof

- Passport Size Photo

Address Proof

- Aadhar Card

- Bank Statement

ID Proof

- Pancard

- Voter Id / Driving License

Company Proof

- EB Bill

- Rental Agreement

- NOC

Note: All the above documents are a scanned copy and in PDF format only.

Fill the Form and Get an Immediate Call back from our Specialist

Easy EMI Options Available.

We hate spam. 100% Confidential.

Advantages of Pvt Ltd Company

Easy Fund Raising

A Private Limited Company can raise its funds through debt, applying for a loan, raising equity capital, finding an investor, and getting investment from venture capitalist.

Separate Legal Entity

A private limited company is free from its members and it is considered as a separate legal entity. Agreements, deeds, and contracts all are executed under the name of the company.

Protects Owner's Liability

A shareholder of a company liable for the company’s debt only up to his share value investment in the company. Other than the personal asset is a well secured one.

Easy Governance

A private limited company is a legal entity govern under the regulatory norms of the Indian Companies Act, 2008.

Increase Credibility

Both profits and losses are part of a business. Suppose, a financial difficulty can make the loss but it is limited until the money investment.

Increase Potential Growth

The potential growth of a private limited is a stable one. When the business expands it can convert to a public limited company by the addition of shareholders, raising funds, and add new investors.

Easy Transferable

There is no restriction for the transfer of shares to the other shareholder. Just a transfer deed between Transferor and Transferee is enough.

Selling of Business

Selling a Private limited company is an easy option under the name of voluntary wind-up. The selling of business never involves personal assets.

Important Terms to Remember

-

DIN

-

Form SPICe (INC-32)

-

e-MoA (INC-33)

-

e-AoA (INC-34)

-

PAN and TAN

-

Docs Required

What is DSC (Digital Signature Certificate)

DSC is an electronic form of digital signature certification issued by the licensed Certifying Authority granted by the Ministry of Corporate Affairs. Digital Signature is more equal to the physical signature signed by the individual. The main functionality of DSC is to authenticate the individual signature at government agencies and their legal filing.

There are three types of DSCs are used for its authoritative procedure.

- Class I used for personal use.

- Class II is a common DSC used to file Income tax and other processes.

- Class III is a highly encrypted form of the key used for an E-commerce application and E-tendering.

Filing the DSC form requires the Individual ID proof and Address proof.