One Person Company Registration in India

Package Includes (1 Year)

GSTR - 1 Filing

GSTR - 3B Filing

Dedicated Accountant

Send us an Inquiry

Register Your One Person Company with Raj Softech BCS

One Person Company registration is a new form of business that is operated by an individual. One Person Company comes under the regulation of Companies Act, 2013. OPC form of business encourages the business individual to start their own business without any partnership collaboration. At the same time, this form of business enjoys the status of a company. Only one shareholder acts as the founder, owner, and shareholder of this company. The entire control of the business comes into the hand of a single individual. One Person Company is renowned as a legal entity. There is no specified amount mention as share capital to start an OPC. Director appointment is mere optional to operate this business. Annual compliances of an OPC is too minimal rather than a private limited company.

Startup

Market Price : ₹11999

Raj Softech Price : ₹8999 +GST

Government Fee : Included

Company Registration Services with Basic Incorporation Pack.

EMI Options Available | Transparent Pricing

Important Terms

Startup Plus

Market Price : ₹22999

Raj Softech Price : ₹18999 +GST

Government Fee : Included

Company Registration with GST Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

Startup Pro

Market Price : ₹34999

Raj Softech Price : ₹28999 +GST

Government Fee : Included

Company Registration with GST, ROC Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

Startup Proplus

Market Price : ₹42999

Raj Softech Price : ₹33999 +GST

Government Fee : Included

Company Registration with GST, ROC , IT, Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

RAJ SOFTECHPROTECT+

Protect your brand name. We will safeguard your company name and prevent misusing your brand reputation. We extend our support to increase protection:

A 10yr valid trademark registration certificate (+) Free expert advice to protect your brand name.

All this for Rs. 6999 only.

RAJ SOFTECH GO-LIVE

Today, a business website is mandatory to gain global exposure and meet more new customers every single day. With each business website you will get:

Free five (5) business emails (+) 1-year web hosting (+) '.com' domain name (+) a responsive website.

All this for Rs. 14999 only.

Mandatory Conversion of OPC to Pvt Ltd Company

Share capital limit is one of the primary factors that leads an OPC to convert into a Private Limited or Public limited company. The capital investment of an OPC should not be more than Rs. 50 lakhs. The annual turnover of the OPC should maintain the limit of Rs. 2 crores. When these limitations exceed obviously the company must convert into a private limited or public limited company according to the norms of the Indian Companies Act.

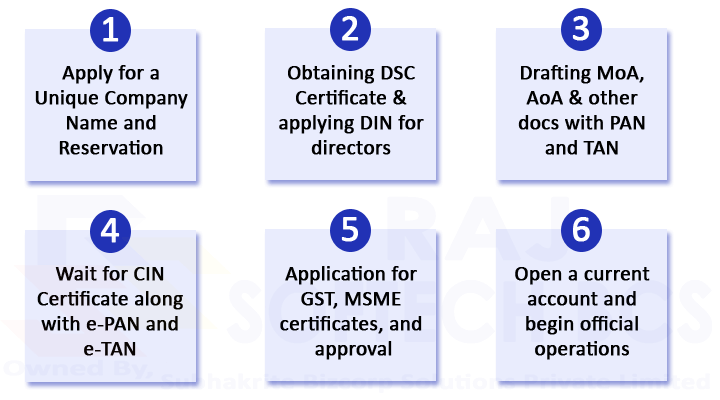

OPC Registration Process

Photo Proof

- Passport Size Photo

Address Proof

- Aadhar Card

- Bank Statement

ID Proof

- Pancard

- Voter Id / Driving License

Company Proof

- EB Bill

- Rental Agreement

- NOC

Note: All the above documents are a scanned copy and in PDF format only.

Fill the Form and Get an Immediate Call back from our Specialist

Easy EMI Options Available.

We hate spam. 100% Confidential.

Advantages of One Person Company

- No Minimum Capital to Start: There is no prescribed monetary limitation for the initiation of OPC.

- Protects Owner’s Liability: As an individual business owner, OPC is limited to its liability on the amount of investment.

- High Credibility: As similar to the private and public limited companies, OPC is also renowned as a single owner company.

- Separate Legal Entity: Both the owner and company are distinct. It is the big difference between OPC and proprietorship firm.

- Easy Governance: Without annual meetings, and the approval of partners, the single owner can easily manage his business.

- Increase Potential Growth: The growth of the company is a possible one, but the growth of the company requires obligatory conversion.

Important Terms to Remember

-

DIN

-

Form SPICe (INC-32)

-

e-MoA (INC-33)

-

e-AoA (INC-34)

-

PAN and TAN

-

Docs Required

What is DSC (Digital Signature Certificate)

DSC is an electronic form of digital signature certification issued by the licensed Certifying Authority granted by the Ministry of Corporate Affairs. Digital Signature is more equal to the physical signature signed by the individual. The main functionality of DSC is to authenticate the individual signature at government agencies and their legal filing.

There are three types of DSCs are used for its authoritative procedure.

- Class I used for personal use.

- Class II is a common DSC used to file Income tax and other processes.

- Class III is a highly encrypted form of the key used for an E-commerce application and E-tendering.

Filing the DSC form requires the Individual ID proof and Address proof.