Online GST Registration Services at Rs. 999 – Raj Softech BCS

Package Includes (1 Year)

GST Registration

GST Certificate

DSC Certificate

Send us an Inquiry

What is GST?

As we all know, GST stands for Good and Service Tax, and it is the most pioneering and remarkable indirect Tax in India after post-independence. The main motive behind GST is to reduce multiple taxations into a single one. GST Act was passed in the parliament on the 29th of March 2017 and came into progress on the 1st of July 2017.

When GST came into progress, it replaced 17 indirect taxes. That includes Nine state-level taxes and Eight central-level taxes, which also reduced 23 cesses of both the central and the state that exited earlier.

The motive of GST implementation was ‘ONE NATION ONE TAX’ GST came into action, with the consideration of 1300 goods and 500 services. The Government of India has eliminated Cascading effect by introducing GST with the expectation of a reduction of goods and services that can bring benefit to the consumers.

There are a few types of GST, they are CGST, SGST, IGST, and UTGST.

- (CGST) Central Goods and Service Tax.

- (SGST) State Goods and Service Tax.

- (IGST) Integrated Goods and Services Tax.

- (UTGST) Union Territory Goods and Services Tax.

Is GST Registration Mandatory?

GST is mandatory for all businesses in India. Where annual turnover exceeds 40 lakhs for goods and 20 lakhs for services, this may change for some states.

And for others, GST registration is not mandatory. When you register under GST, you will consider the legal supplier of Goods and services. After registration, he is legally eligible to collect tax from the consumers.

There are few States in India that comes under the special category, for those states have to register under GST if their annual turnover crosses 10lakhs.

A Taxable person can be an individual, company, firm, LLP, local authorities, or artificial judicial person. As per the latest GST registration, the limit have changed to 40lakhs. A person whose turnover exceeds 40lakhs is eligible to pay GST. Previously it was 20lakhs.

Our GST Registration Process

Who Needs GST Registration Number?

Benefits of GST

- You can legally collect taxes from your customers for every sale of goods or services and pass on the Tax Benefits to suppliers.

- Your Business will become 100% tax Compliant and protect you from legal disputes.

- All nationalized and private sector banks in India are accepting GST Registration Document for opening a Current Account and/or Business Account.

- GST registered businesses are given preferences while applying for various states and central government tenders.

- Improve your profit scale by claiming Input Tax Credits for the purchases you have made in the current calendar month.

- Provision to expand your businesses on a large scale of various channels like online, import-exports.

- You can submit your GST registration document to open payment gateway accounts, use mobile wallets, and other online payment services.

Required Documents for GST Registration

Sole Proprietor / Individual

- Owner PAN Card

- Owner Aadhar Card

- Owner Passport size Photo

- Bank Account Details*

- Address Proof*

Sole Proprietor / Individual

- Company PAN Card

- Certificate of Incorporation given by Ministry of Corporate Affairs

- Memorandum of Association/Articles of Association

- Address Proof of the Company*

- Board Resolutions Letter of appointment of the authorized signatory

- PAN Card and Aadhar Card of the authorized signatory

- PAN Card and Aadhar Card of all company directors

- Passport size photo of all company directors

- Bank Account Details*

Partnership Firm/LLP

- PAN Card of all partners

- Copy of partnership deed

- Address Proof of the Company*

- Passport size photo of all partners

- Address proof of partners*

- Letter Head of appointment of the authorized signatory

- PAN Card and Aadhar Card of the authorized signatory

- In case of LLP, registration certificate/Board Resolution LLP

- Bank Account Details*

GST Penalty

The GST Act specifies 21 various offenses that are eligible to attract penalties under the GST regime.

- Any Business not having GST Registration: 100% tax due or Rs. 10,000 (whichever is higher)

- Not giving GST invoice: 100% tax due or Rs. 10,000 (whichever is higher)

- Incorrect GST Invoicing: Rs.25,000

- Not filing GST Tax Returns: 100% tax due or Rs. 10,000 (whichever is higher)

- Delayed filing GST Returns: For Nil Return, Rs.20 Per Day. Regular Returns Rs.200 Per Day up to a maximum of Rs.5000

- Choosing Composition Scheme even if not eligible: 100% tax due or Rs. 10,000(whichever is higher)

May include jail term for fraud cases of higher value.

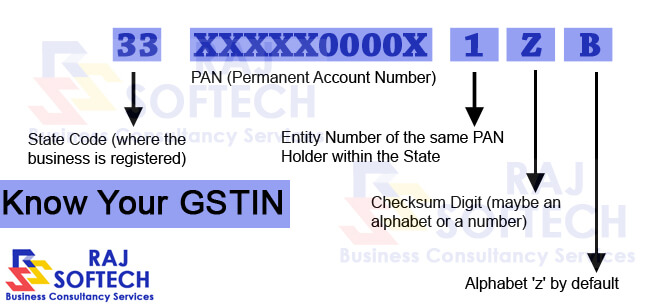

What is GSTIN?

GSTIN is a mandatory number that is allocated by the government for every entity according to their business module. GSTIN number consists of 15 digital number codes, in brief.

- The first 2 numbers represent the state code

- The next 10 digit number represents the Pan number of the entity

- 13th digit represents the number of registration on within a state

- Along with the last 2 checks will be default code.

Make ensure the GSTIN number only represent you are an eligible taxpayer to collect the tax from the consumers.

What are the Eligible Criteria for GST Registration?

As we all know, there is a huge population who are eligible for GST registration, BUt this can clarify your doubts. Registering the GST is beneficial for customers, individuals, and the government. GST registration is a process done online using the GST portal. Some people are ready to register their business in GST but don’t know the exact procedure. For those people, @Raj softech BCS properly guides them to register their company Individuals who registered before the GST law are eligible for the registration of GST.

The non-resident individual taxable person, a casual taxable person, A company with a turnover of 40lakhs, an individual who sells goods through e-commerce, Business with an annual turnover of 20lakhs or more are eligible for GST registration.

There is various GST registration available. They are,

- Regular GST registration

- Composition GST registration

- Special GST registration

After registering for the GST. All the registered persons will be given a unique number called GSTIN which stands for Goods and Service Tax Identification Number. It is a 15-digit number given to taxpayers known as GSTIN by the government after registering for the GST.

Aggregate Turnover

Aggregate turnover is nothing but calculated based on PAN(Permanent Account Number), and it is the foremost thing, to decide threshold limits under GST. Accordonfiing to the GST Law, those whose income exceeds 40lakhs for goods and 20lakhs for services should register under GST.

If an individual has three companies, which have registered under the same PAN turnover of all branches, will be considered to ascertain Aggregate Turnover.

Inter-state Business

Interstate supply is a supply of goods and services within the state border. That is when the manufacturer of the company and the receiver of the goods are found in the same State.

In that case, the taxable person is eligible to pay both the central and the state government tax. Customers would have noticed in their bills CGST and SGST.

For example, when manufactured goods are supplied from Coimbatore to Chennai, that is within the State. This kind of tax is applicable when the goods are supplied within the State or the Union Territory.

E-commerce Platform

As we all know, E-commerce is the fastest-growing sector in India, and we people are getting comfortable with it. At this time, here comes a venturing question of whether every E-commerce business applies for their GST.

Yes, every E-commerce seller and E-commerce operator should undergo GST registration. An E-commerce operator is eligible for the payment of taxes on behalf of their supplier, and there is no threshold limit for them.

Casual Taxable Persons

As per the GST act of 2017, a Casual Taxable person is considered as a person who undergoes transaction from time to time involving the supply of goods and services or both, Whether as an agent or as a principal or with any other capacity but they don’t have a fixed place for business or resident in India.

For example, Mr. Vikram has a shoe manufacturing unit in Rajasthan, but he had registered his place of business in Gujarat and had a stall in Chennai, Tamil Nadu. Where also he tells his products. In this case, Mr.Vikram has to register as a casual taxable person before practicing his godown unit in Chennai.

There is no threshold limit for who did the registration under casual taxable person. The Casual taxable person shall apply for GST registration at least five days before the commencement of business.

Voluntary Registration

However, there will be some person who does not come under any criteria of GST registration, those people don’t have any mandatory law to register under GST. But they can register under GST with their interest.

For those people, as per the GST law passed in 2017, have a separate registration based on their interests. They have the option to register under GST at their Willingness. For those, they have to know the merits and the demerits of the registration of GST. One of the major advantages of voluntary GST registration is it can enlarge its market, sell online and attract customers.

What is Input Tax Credit?

As mentioned already that the GST is the destination-based tax. If the Tax-payer purchases their goods or services from any supplier, it is claimable under the Goods and Services Tax Act.

As per the rule, ITC is nothing but the tax that business pays on a purchase of raw materials or goods. It is claimable when the tax-payer makes a sale. It reduces the Tax liability for the payer and also make some exempt supplies.

What are the GST Tax Rates?

According to the Good and Service Act, the rate of the GST percentage will vary from business to business. It also depends on the carryover by goods and services rendered by them.

And also we can apply for exemption while engaged with the agricultural-related exports and imports of goods/services. According to the basic standards, we have a Four slab of 5,12,18,28 percentage except for the gold and ornaments. The aside of tax on gold is 3%.

GST - FAQ

GST is a tax levy on the supply of goods and services. It is a value-added tax collected in each stage of the product supply and service offerings. The replacement of GST helps to abolish many indirect taxations. GST is the single indirect tax system uniformly followed in entire India

There are four different types of GST using at the time of business taxation. Integrated Goods and Services Tax (IGST), State Goods and Services Tax (SGST), Central Goods and Services Tax (CGST), and Union Territory Goods and Services Tax (UTGST). Each taxation rate completely differs from other taxation rates.

First of all, we need to know the tax slab for your specific business or service. 0%,5%,12%18% and 28% are the common GST taxation slabs. Then the separation of IGST or CGST and SGST will decide your overall GST taxation.

Imports of goods and services come under the Inter-state supply and the IGST levies on imports on goods and services in India. A business import in an inter-state will consume the SGST. Otherwise, the export will treat as zero percent. There is no tax payable for the export of goods and service supply.

A business that crosses the turnover of more than Rs.40 lakhs is known as a taxable business. Otherwise, the taxable business supply which exceeds the turnover of more than Rs.20 lakhs in a financial year needs to obtain this GST registration. If an Individual failed to register GST as per law, he/she would legally pay the penalty.

GSTIN stands for Goods and Services Tax Identification Number. GST identification number is a 15-digit number issued at the time of their GST registration. In the GST portal, this number used for your business consolidation. It is a useful number at the time of GSTcompliances and other GST validations too.

Both the goods and service supply is registered under the GST. Sometimes, the reverse charge is applicable at GST filing and it directly pays to the government. Suppose, If a supplier is not registered under GST and selling the product to a vendor at the time, this reverse charge will be raised. But obviously, it is paid by the vendor rather than the supplier.

Businesses and individuals who generate their annual income less than Rs.20 lakhs are e4xempt from this GST registration. The hill state and Northeastern states with the lower limit turnover of Rs. 10 lakhs and below also exempt from this GST registration.

Mostly agriculture and food relating products are getting its total exemption in GST. Otherwise, less- luxury products and essential services like education are exempt from GST.

According to the GST act, a GST penalty of 10% from the total tax amount is a receivable one. If the GST is not paying for a period of more than a year the taxpayer must meet the prosecution and penalty with arrest.