Form a Company Now

Register Your First LLP Firm in India with Raj Softech BCS

Are you looking for professional guidance for your LLP registration and compliance? Raj Softech Business Consultancy Services is the primary destination for you. We are a part of Raj Softech Solutions (I) Pvt Ltd, an IT and ITES based service provider offering timely services for your business development. Certified CA, CS, Auditors, and lawyers are taking over the legal responsibility and complete them with a short span of business days. We shoulder your legal responsibilities until their completion. This form of business is similar to Pvt Ltd, but the owners are called Limited Liable Partners. This type of registration is suitable for particular forms of businesses where two or more persons are involved in the conventional partnership. Ownership Transfer is a risky process as compared to Pvt Ltd. Hence, the fund-raising is becoming a difficult part.

What is Limited Liability Partnership (LLP)?

LLP is a body corporate that comes with the benefit of limited liability to its members. This form of business comes with the low cost of compliance and a flexible partnership. It is the new form of business structure apt to small and medium enterprises. The members of the parliament passed the limited liability partnership act in 2008. So, LLP registration follows the norms and regulations of the limited liability partnership Act.

The norms of the LLP are distinct from the Indian partnership Act, 1932, and its norms. According to the law, LLP is a separate legal entity from its members. LLP has perpetual succession and carries legal existence. LLP agreement is a written consent is the deciding factor for the roles, duties, powers, and responsibilities of each partner in this firm. The profit-sharing of the business in LLP followed as same as the regular partnership firm. The LLP firm can continue its existence even irrespective of the change of its partners. Moreover, the mutual agreements and contracts all enter into the name of LLP rather than the partners.

Startup

Market Price : ₹ 11999

Raj Softech Price : ₹ 8500 +GST

Government Fee : Included

Company Registration Services with Basic Incorporation Pack.

EMI Options Available | Transparent Pricing

Important Terms

Startup Plus

Market Price : ₹ 22999

Raj Softech Price : ₹ 18500 +GST

Government Fee : Included

Company Registration with GST Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

Startup Pro

Market Price : ₹ 34999

Raj Softech Price : ₹ 28500 +GST

Government Fee : Included

Company Registration with GST, ROC Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

Startup Proplus

Market Price : ₹ 42999

Raj Softech Price : ₹ 33500 +GST

Government Fee : Included

Company Registration with GST, ROC , IT, Compliance Services

EMI Options Available | Transparent Pricing

Important Terms

RAJ SOFTECHPROTECT+

Protect your brand name. We will safeguard your company name and prevent misusing your brand reputation. We extend our support to increase protection:

A 10yr valid trademark registration certificate (+) Free expert advice to protect your brand name.

All this for Rs. 6999 only.

RAJ SOFTECH GO-LIVE

Today, a business website is mandatory to gain global exposure and meet more new customers every single day. With each business website you will get:

Free five (5) business emails (+) 1-year web hosting (+) '.com' domain name (+) a responsive website.

All this for Rs. 14999 only.

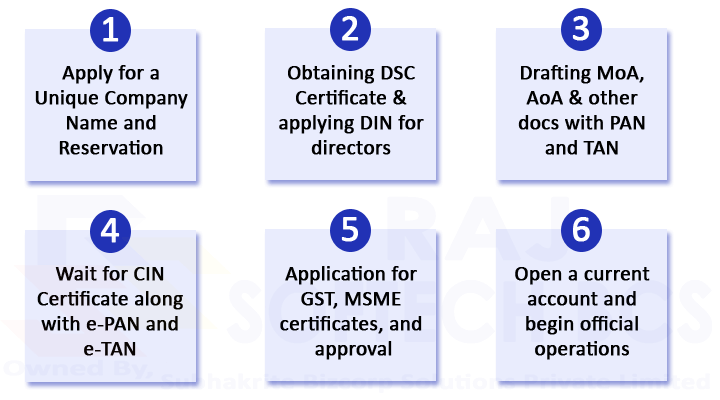

Our LLP Registration Process

Photo Proof

- Passport Size Photo

Address Proof

- Aadhar Card

- Bank Statement

ID Proof

- Pancard

- Voter Id / Driving License

Company Proof

- EB Bill

- Rental Agreement

- NOC

Note: All the above documents are a scanned copy and in PDF format only.

Fill the Form and Get an Immediate Call back from our Specialist

Easy EMI Options Available.

We hate spam. 100% Confidential.

Advantages of LLP Firm in India

Separate Entity

Limited Liability Partnership is a separate legal entity free from its subscribers or members.

Legal Recognition

LLPs are considered as a separate legal entity. All the business agreements and contracts are signed only in the name of the company.

Minimum Capital

There is no volume of the capital amount is prescribed for LLP. So, the minimum capital amount is enough for LLP registration.

No Owner/Manager

The members of the LLP are just the subscribers, and they can come out of the business at any time. They are not called as a manager or owner.

Company Structure

A limited liability partnership is a firm that carries the structure of a body corporate than the status of a company.

Owning a Property

This model gives handsome discounts while buying and earns a profit when surplus inventory (property) is offloaded.

Important Terms to Remember

-

DIN

-

Form SPICe (INC-32)

-

e-MoA (INC-33)

-

e-AoA (INC-34)

-

PAN and TAN

-

Docs Required

What is DSC (Digital Signature Certificate)

DSC is an electronic form of digital signature certification issued by the licensed Certifying Authority granted by the Ministry of Corporate Affairs. Digital Signature is more equal to the physical signature signed by the individual. The main functionality of DSC is to authenticate the individual signature at government agencies and their legal filing.

There are three types of DSCs are used for its authoritative procedure.

- Class I used for personal use.

- Class II is a common DSC used to file Income tax and other processes.

- Class III is a highly encrypted form of the key used for an E-commerce application and E-tendering.

Filing the DSC form requires the Individual ID proof and Address proof.